Fringe Rates, F&A Rates, and Indirect Cost Rates for NIH SBIR Proposals

COMMON QUESTIONS ABOUT FRINGE AND F&A RATES WHEN WRITING AN NIH SBIR PROPOSAL

Jameson & Company CPAs are highly specialized and focus exclusively on government award accounting, including grants from the National Institute of Science (NIH). We understand the complexity of applying for and receiving government funds and the positive and sometimes negative ramifications it can have one your business. We want to help you avoid the pitfalls, and for NIH grants, that means properly projecting your fringe and F&A rates. Here are the most common questions we hear from our clients when calculating and projecting Fringe and F&A rates for an NIH grant.

Q. Let’s start with the basics: What do Fringe and F&A rates mean?

A. If you are applying for an NIH grant, you need to understand Fringe and F&A rates.

Fringe rates are employee-based; as the name implies, they represent the fringe benefits a business must pay to hire and retain employees, whether they are working directly or indirectly on the project. If you pay for things like holidays and vacation, health and dental insurance, payroll taxes, worker’s comp and the like, you need to develop an appropriate fringe benefit rate.

F&A rates (Facilities and Administrative rate), also known as indirect costs rates, represent the indirect costs associated with running your business and benefit ALL your research/projects. Not all of your costs will be directly related to one specific project and as such, the government expects you to have indirect costs. These costs (such as rent and electricity) will be recovered proportionally by all of your projects via your F&A rate.

Understanding how these rates work is critical to your cash flow and financial viability!

Q. What mistakes do NIH grantees make when projecting their Fringe and F&A rates?

A. Too many people pull a number out of the sky and most use a ridiculously low F&A rate.

They think this conservative approach will be more attractive to the government. However, this approach could get you into serious financial trouble. You need a well-thought-out plan that’s developed from the bottom up and reflects the real cost of business.

Most funding programs will allow a fee and, often, people forget or intentionally omit it on the proposal. The SBIR program allows a 7% fee. If you take, this can help finance any unallowable costs and provide a little financial security.

For more information about projecting your F&A rate, click here.

For more information on how to negotiate an indirect cost rate for a NIH Phase II grant, click here.

Q. What are the ramifications of poorly projected Fringe and F&A rates?

A. Most people, even experienced CPAs, don’t understand the difference between a projected rate and your actual rate. This is where the trouble begins.

If your actual rate—the amount you actually spend on indirect costs, is higher than the rate you projected, you could put your business in jeopardy as you will need to fund the excess cost from another funding source, such as credit cards, second mortgages, perhaps your personal bank account.

On the flipside, if your actual rate is lower than what you projected, you could end up overbilling the government and committing what we call inadvertent fraud. This occurs when you file your quarterly Federal Financial Form or SF-425. In case you are not aware:

“By signing this report, I certify that it is true, complete, and accurate to the best of my knowledge. I’m aware that any false, fictitious, or fraudulent information may subject me to criminal, civil or administrative penalties.”

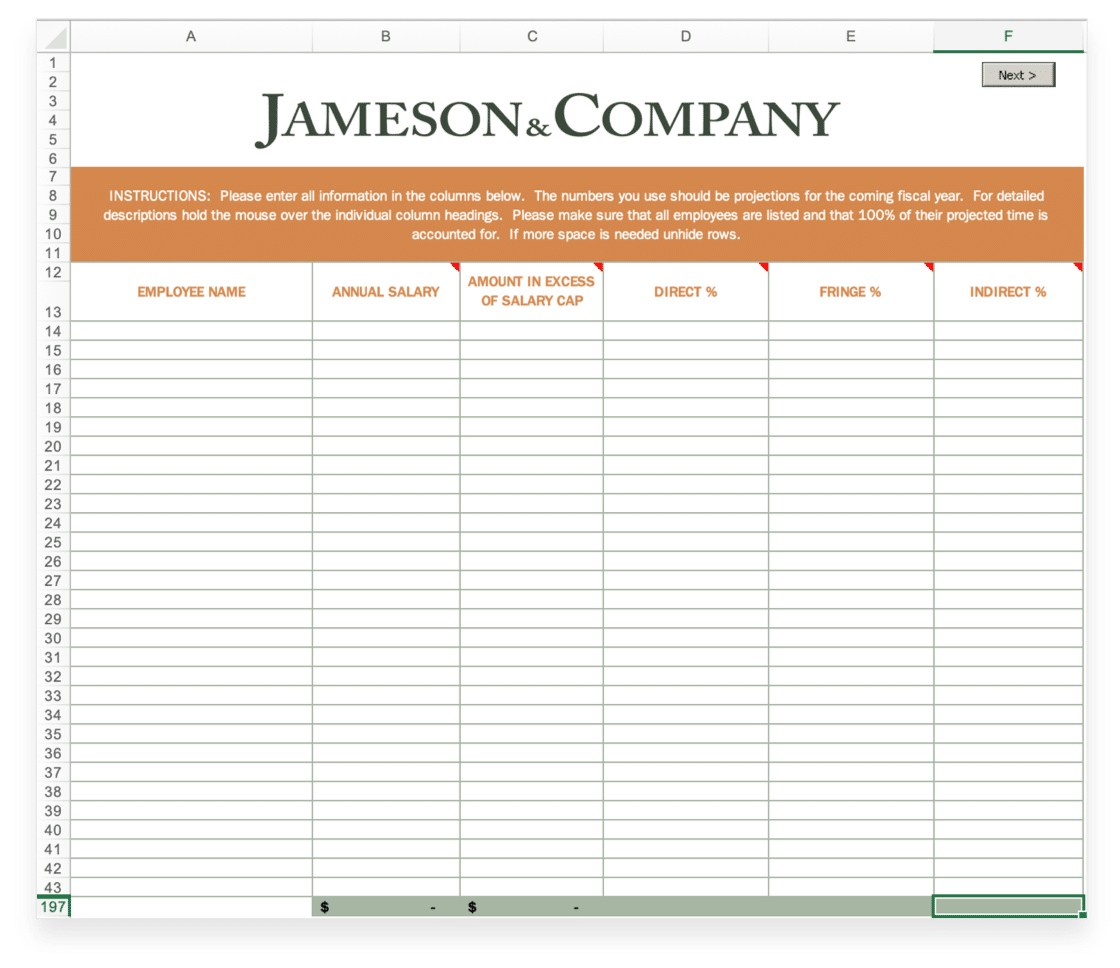

When you overbill the government, you can end up in serious trouble. I suggest you develop your indirect cost rates using our free indirect rate templates, then speak to us if you need feedback or more insights.

I also suggest that you constantly monitor your actual indirect rates versus your projected (proposed) indirect rates. Our clients rely on us to provide them regular feedback as we have years of experience working with FAR Part 31, and all the supplemental agency regulations, and know the difference between a seasonal and a structural indirect rate variance. I think this gives them peace of mind.

For more information on how the wrong F&A rate can damage your business, click here.

Q. What tips do you have for grantees as they calculate their Fringe rate?

A. Let’s start with fringe costs. Make sure you include all of your fringe costs into your fringe calculation. You need to benchmark FICA, SUTA and FUTA payroll taxes, paid holidays, sick and vacation pay, health and dental benefits, and 401(k) matching and administrative costs if that’s a perk that you need to pay. Know that fringe rates vary greatly depending on what part of the country you operate in and what type of benefits you need to offer to attract and retain talented employees. There is a huge difference in labor markets between Silicon Valley and Ames, Iowa.

If you have unallowable labor, don’t forget to include that into your fringe base, too. Unallowable labor is the time an employee spends on an activity that’s not an allowable expense, such as working on venture capital or private equity fundraising.

Q. What tips do you have for grantees as they calculate their NIH F&A rate?

A. Make sure to include an ample budget for INDIRECT LABOR costs. Your government-funded project is part of your business, and it takes time and money for you to run your business. The biggest mistake most people make is overestimating how much time employees will actually spend working in a project vs. doing other “things”. Most employees are 60 to 90% billable to a project and spend the rest of their time performing administrative functions like managing vendors, subcontractors, consultants, lawyers, accountants and employees; writing grants and trying to grow the business. Don’t sell yourself short here. Be honest about what it takes to run a business. The government expects you to have these costs to operate your company!

Q. What if the project requires subcontractors? How does that impact how you calculate an F&A rate?

A. If you are sub-contracting work out, be sure to include direct subcontracting costs in the denominator of your F&A rate! You are only required to exclude subcontractor costs in your F&A rate when you negotiate an F&A rate > 40%.

Here’s something many grantees don’t understand, and it’s pivotal:

When you hire a subcontractor, you are 100% responsible for their compliance with the FAR and the agency’s supplemental regulations. They are held to the same standards.

Be sure to keep close tabs on your subcontractors. For more information on the accounting requirements for subcontractors, click here!

Q. If the project requires equipment, who owns it?

A. This is a complex subject that requires a longer discussion, but let me just say, if it’s equipment you want to use on several projects or think would be of long-term value to the business, then you should treat it as a fixed asset and charge depreciation expense through your F&A rate.

Q. How do F&A rates, or indirect cost rates, work for an NIH SBIR Phase I proposal?

A: NIH SBIR Phase I grants have provisions that allow you to take up to a 40% F&A rate and generally allow for up to 35% fringe without question. It is important to understand that if you win your proposal you can subsequently re-budget, if necessary, to reduce your indirect budget and increase your direct costs budget, however you can’t go in the other direction.

Q. Any last words of advice?

A. Do your homework, fill out the indirect rate projection templates from the bottom up and don’t be surprised when the fringe and F&A rates you project are much higher than you initially envisioned. Finally, we’re happy to review your projections with you to provide some benchmarks and guidance. It’s a great—and free—way for you to check us out!

Ready to Learn More? Speak With A Government Funding Award Expert!

Call Now: 781-862-5170 – or – Schedule A Call

To better understand F&A rates, or “indirect cost rates”, please reference the related topics from our Learning Center!

- How the Wrong Indirect Rate Can Damage Your Business

- How to Project an Indirect Cost Rate

- How to Project an Indirect Cost Rate for a Phase II Proposal

- Real Life Examples of a Reasonable Indirect Cost Rate

- Understanding the Indirect Cost Rate Cycle

Download our Fringe and F&A rate projection templates.

If you’re putting together a Phase I proposal, read our blog, A Simple Approach to Budgeting an NIH SBIR Phase I Grant

I’ve been in practice for over 40 years helping our small business clients procure, manage, and survive audits on more than $6 billion in federal government contract and grant funding. We’ve been featured presenters and panel moderators at Tech Connect’s National SBIR/STTR conferences since 2010, and I’ve presented at the DOD’s Mentor Protégé Summit and present regularly for several state and local organizations.

GET THE SOLUTION YOU NEED NOW

Learn more about how we can support your needs and objectives. Join us for an enlightening discussion and take the first step towards a partnership that can make a difference.

JOIN OUR NEXT WEBINAR

Join us for an upcoming webinar where we’ll dive deep into the latest insights and strategies.

Reserve your spot today and take a step toward gaining valuable knowledge that can make a real impact.