NSF PAPPG: NSF For-Profit Organizations Accounting Requirements

NSF Grantees Must Comply With The PAPPG

Small Business Innovative Research (SBIR) Phase I and II awards must comply with the NSF Proposal and Award Policies and Procedures (PAPPG), which requires ongoing FAR Part 31 accounting. Because National Science Foundation (NSF) awards and the PAPPG are so poorly written, most grantees are lax about the financial management of their grant – which can be very expensive!

How does this happen?

The NSF PAPPG Requires FAR Part 31 and 2 CFR 200

Often, NSF awardees think the PAPPG doesn’t relate to their for-profit award. That’s not entirely their fault.

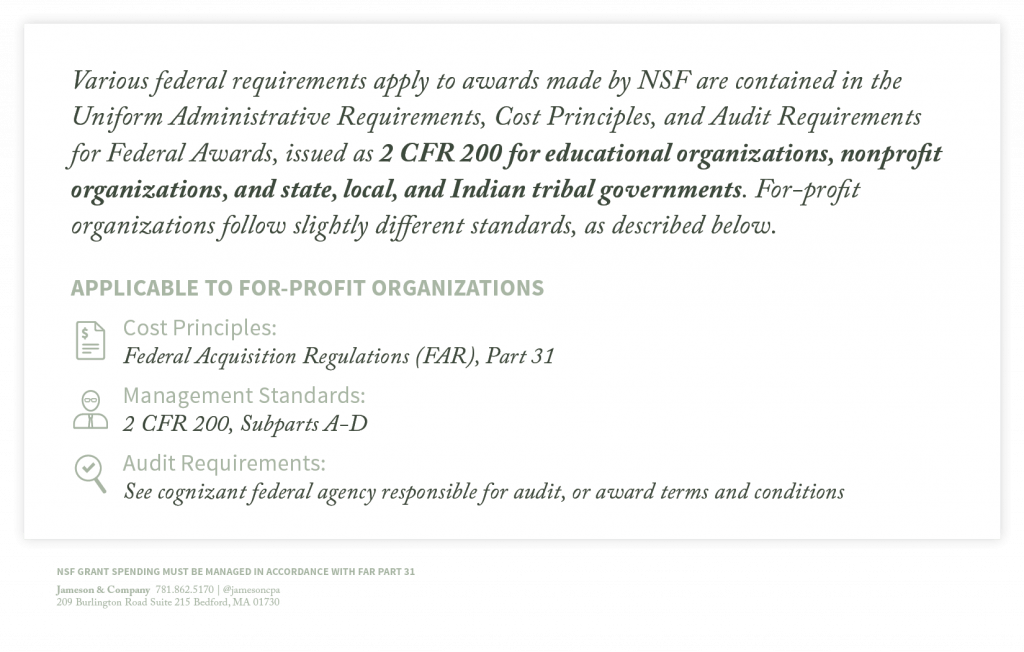

In our opinion, the PAPPG financial management requirements are poorly written because NSF’s grant rules stem from 2 CFR 200, which are regulations written for hospitals, universities, state and local governments and other non-profits.

NSF then tweaks these regulations to make them apply to for-profits. The second paragraph (below) shows NSF’s attempt to remedy the confusion they created by failing to write better regulations:

If you’re a for-profit NSF grantee, here’s what you need to know:

FAR Part 31 Clearly Applies to NSF Grant Spending

The second paragraph clearly requires for-profit NSF grantees to keep their accounting records in accordance with FAR Part 31 (a set of regulations written to apply to for-profit entities).

You May Not Be Audited—And That’s Not Always A Good Thing.

2 CFR 200 includes a Uniform Audit Requirement for grantees. However, 2 CFR 200 was written to apply to (larger) non-profits.

The Uniform Guidance Audit requirement is triggered when an awardee expends more than $750,000 in grant funds during their fiscal year. It is rare for an NSF Phase II awardee to expend more than $750k solely on an NSF award. Most will not need to hire an outside auditor to audit their compliance with FAR Part 31.

This may sound like good news but, actually, it’s unfortunate as any auditor-discovered non-compliance would provide an opportunity to remedy any problems. This lack of audit oversight gives many NSF awardees a false sense of security, which is upended after they file their final spending report.

Representations and Certifications

The Reps and Certs that you sign can be used against you. Here’s how:

- You receive a fixed price Phase I SBIR award from NSF, giving the government no rights to review your accounting records.

- Before you get a Phase II award, the NSF Cost Analysis and Audit Resolution (CAAR) Branch Auditor will ask to see that your Phase I spending was made in accordance with FAR Part 31. This requires you to produce a report on your Phase I spending as if the award were a cost-type funding vehicle. If you fail to produce this reporting correctly, you will not receive your phase II funding.

- Before passing the CAAR audit, you must certify that this is how you keep your books and records.

- Your Phase II SBIR NSF funding award will say that it’s a fixed price award. Again, this may lead you to believe that you no longer need to maintain a FAR Part 31 accounting system. This would be a huge mistake – given that you certified that you maintain a FAR Part 31 system before you received the Phase II in your representations to the Agency!

Beware the NSF IG’s Interpretation of The False Claims Act!

The False Claims Act (FCA) is a federal law that imposes liability on persons and companies who defraud governmental programs.

The federal government has recovered > $40 billion in FCA settlements and judgments. Over 70% of all FCA actions are initiated by whistleblowers, who typically receive 15% – 25% rewards on amounts recovered from the Department of Justice.

Jere Glover has served as the Small Business Administration (SBA) Chief Counsel for Advocacy and was awarded the SBIR Man of the Year in 2006. Glover and his Associate, Ross Nabatoff are two of the country’s foremost legal experts in the Small Business Innovation Research (SBIR) Program, as well as the False Claims Act.

Glover and Nabatoff stated that “NSF Inspector Generals (IGs) consider the cost-type accounting budget the SBIR firm submits to be a statement to the Government. All proposals have a certification that all statements are true.”

Glover elaborated “we have gotten the US Attorneys to realize that in a firm fixed contract there is no requirement to document expenditures and that the budget is a ‘proposed budget. However, when the agents look at the money the SBIR firm spent and it differs from the budget, that doesn’t keep the NSF agents from recommending criminal prosecution.”

In Conclusion, A FAR Part 31 Compliant Accounting System Avoids Problems Down the Road

While we believe there are better ways for an agency to create accountability of its awardees, we reiterate the importance of keeping your SBIR and STTR NSF grant spending in accordance with FAR Part 31 to comply with the PAPPG.

Maintaining a set of books in accordance with the Federal Acquisition Regulations Part 31 is not a negligible cost. Our clients outsource this compliance to us to avoid problems. A JamesonWorx Basic package would be a great fit for most NSF Phase I awardees at prices that start at $800/month (plus the cost of representing them during the CAP audit). It’s critical to budget for these types of costs in your cost proposal.

To learn more, please visit the Critical Reading section of our website.

Ready to Get Started? Speak With A Government Funding Award Expert!

Call Toll Free: 833-415-3900 – or – Schedule A Call

I’ve been in practice for over 40 years helping our small business clients procure, manage, and survive audits on more than $6 billion in federal government contract and grant funding. We’ve been featured presenters and panel moderators at Tech Connect’s National SBIR/STTR conferences since 2010, and I’ve presented at the DOD’s Mentor Protégé Summit and present regularly for several state and local organizations.

GET THE SOLUTION YOU NEED NOW

Learn more about how we can support your needs and objectives. Join us for an enlightening discussion and take the first step towards a partnership that can make a difference.

JOIN OUR NEXT WEBINAR

Join us for an upcoming webinar where we’ll dive deep into the latest insights and strategies.

Reserve your spot today and take a step toward gaining valuable knowledge that can make a real impact.