NEW DCAA GUIDANCE IMPACTS YOUR INCURRED COST SUBMISSION AUDIT

The auditing arm of the Department of Defense, the Defense Contract Audit Agency (DCAA), recently released new guidance for applying materiality for incurred cost submission audits.

Materiality is an accounting concept used by auditors to determine whether an amount ($) is significant and could impact the users of the information, in this case a DOD agency customer. In this blog, we’ll explain this new policy, how it works, and what it means.

A LITTLE BACKGROUND ON DCAA, INCURRED COST SUBMISSION AUDITS, AND MATERIALITY.

Recently, DCAA put a tremendous emphasis on clearing its backlog of incurred cost submissions to audit. This new policy provides DCAA auditors with important guidance for determining which areas of an incurred cost submission are “material” (significant to the user) and when to drill down and perform further audit procedures while also providing leeway for the auditor to exercise professional judgement.

Annual incurred cost submissions are lengthy financial reports required by all companies who receive cost-type funding – the government’s primary method of funding for Research, Development, Test and Evaluation (RDT&E). Common examples of cost-type funding vehicles include:

SBIR – Small Business Innovative Research

STTR – Small Business Technology Transfer

RIF – Rapid Innovation Fund

BAA – Broad Agency Announcements

IDIQ – Indefinite Delivery Indefinite Quantity

HOW DOES A DCAA AUDITOR DETERMINE WHEN SPENDING IS “SIGNIFICANT”?

The new guidance provides the auditor with financial thresholds to guide his or her decision on which areas to test further. Here’s a step-by-step example of how the process would work in an annual incurred cost submission audit.

Step 1. Calculating Quantified Materiality

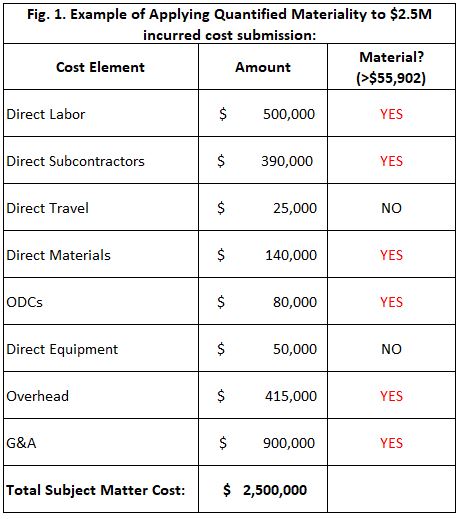

For example, let’s say you are a DOD contractor with an incurred cost submission with $2.5M in total “subject matter” (annual expenditures). First, the DCAA auditor will quantify materiality.

For an incurred cost submission audit with expenditures from $1 to $1B, the formula is:

$5000 x (expenditures/100,000) .75

Using that formula, your incurred cost submission quantified materiality equals:

$5000 x (2,500,000/100,000) .75 = $55,902

Next, the auditor will apply this number to the budget elements that make up your DOD incurred cost submission. Obviously, the $55,902 benchmark guides the auditor to look further into higher cost areas, considered to be areas of greater risk.

Step 2. Calculating Adjusted Quantified Materiality

After that, the auditor will calculate your adjusted quantified materiality by taking a percentage, ranging anywhere from 20% to 80%, of your quantified materiality.

It’s entirely up to your auditor which percentage is applied. If you have a history of audit findings, you will be tested more than someone considered low-risk.

For instance, let’s assume that the DCAA auditor opted to apply 40% to your quantified materiality.

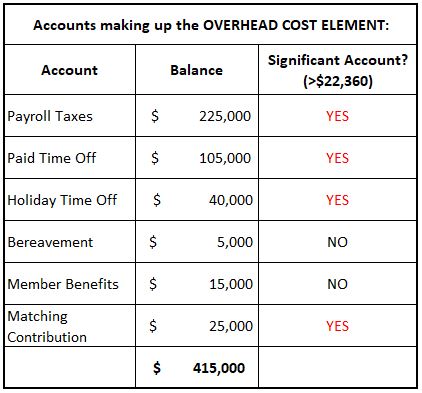

40% of $55,902 = $22,361 Adjusted Quantified Materiality

Step 3. Applying Adjusted Quantified Materiality to Cost Elements that Exceed Quantified Materiality

In figure 1, the auditor used your quantified materiality of $55,902 as a guide to determine which cost elements to examine, such as Overhead Costs.

Now, her or she will look at the accounts that make up your Overhead Costs. This time, using your adjusted quantified materiality as a guide to determine which accounts are subject to testing.

THE BOTTOM LINE: “MATERIAL” EXPENDITURES WILL BE AUDITED

In short, the new guidance will streamline the DCAA audit process for an annual incurred cost submission. However, the annual incurred cost submission is just one of several types of DCAA audits. To learn more about the different types of DCAA audits, please click here.

ABOUT JAMESON

Jameson & Company, CPAs has more than 40 years of experience in the highly specialized field of government contract accounting with clients from coast-to-coast and has represented clients on more than $5 Billion in government funding awards.

Ready to Learn More? Speak With A Government Funding Award Expert!

Call Now: 781-862-5170 – or – Schedule A Call

I’ve been in practice for over 40 years helping our small business clients procure, manage, and survive audits on more than $6 billion in federal government contract and grant funding. We’ve been featured presenters and panel moderators at Tech Connect’s National SBIR/STTR conferences since 2010, and I’ve presented at the DOD’s Mentor Protégé Summit and present regularly for several state and local organizations.

GET THE SOLUTION YOU NEED NOW

Learn more about how we can support your needs and objectives. Join us for an enlightening discussion and take the first step towards a partnership that can make a difference.

JOIN OUR NEXT WEBINAR

Join us for an upcoming webinar where we’ll dive deep into the latest insights and strategies.

Reserve your spot today and take a step toward gaining valuable knowledge that can make a real impact.